It is, says Chancellor Jeremy Hunt, a spending bombshell that will mean the Labour Party breaks its fiscal rules or imposes swingeing taxes on the public.

The shadow chancellor, on the other hand, says it’s a necessary and affordable measure.

Whoever you believe, and we’ll get on to the details shortly, it’s fast becoming clear that Labour’s pledge to lift public investment in green technologies and projects to £28bn a year next parliament is becoming one of the biggest political issues out there.

In one sense, this is a little odd.

The quantum of how much the government does or doesn’t put into capital investment is rarely front page news. It constitutes a small if not trivial percentage of the more than a trillion pounds the state spends each year – far smaller than, for instance, we spend on health or education.

Read more

UK could be at forefront of green Industrial Revolution

Maximising North Sea oil is ‘opposed’ to promise at COP28

But there are three simple reasons why this policy has taken on outsize importance.

The first is that it represents one of the few sizeable spending pledges Labour has committed to.

The second is that the Conservatives would not spend that money, so here we have a genuine difference between the two main parties’ fiscal plans.

The third is that the government is so close to breaking its own fiscal rules that it reckons any Labour plan to spend more money would effectively tip it over the edge.

And it may have a point.

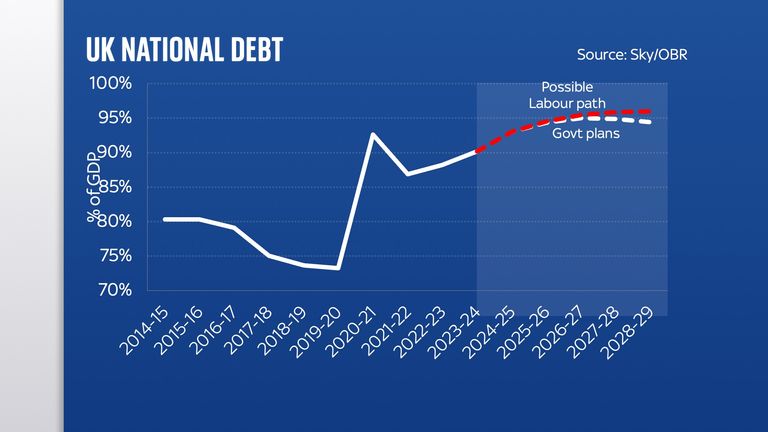

The reasoning here comes back to the fact that this government has pledged that any plans it tables will involve a reduction in the national debt (as a percentage of gross domestic product) by the end of the forecast horizon – in other words in five years’ time.

Here’s what that means in practice: the latest autumn statement forecast that Britain’s underlying net debt would drop from 94.9% of GDP in 2027/28 to 94.4% in 2028/29.

Labour and fiscal rules

Adding Labour’s pledges would mean that between those two years debt would actually rise, ever so slightly, from 95.8% of GDP to 96% of GDP.

So does that mean Labour would break the fiscal rules? Well, not necessarily.

For one thing, it could potentially claim that it would actually cut debt the following year.

This might sound like an accounting trick and it is, but it’s precisely the same accounting trick Conservative governments have been using for years.

Anyway, these rules are hardly set in stone.

Each chancellor, from Gordon Brown onwards, has frequently changed and fiddled the rules.

What really matters is ensuring you have the confidence of financial markets. And while these kinds of fiscal rules help, they don’t automatically add up to fiscal credibility.

Even so, it’s clear that Labour remains torn on its spending pledge.

Insiders say it will not hesitate to reduce its scale if it proves incompatible with its fiscal rules, but that such decisions will need to wait until it has a clearer sense of the economic territory.

And since that territory will depend on the decisions taken by the chancellor at the budget in March (and possibly even another fiscal event later in the year) that will have to wait.

Watered down ambitiousness

But in some senses it has already watered down the ambitiousness of the plan.

What began as an extra £28bn of green spending is now actually significantly lower.

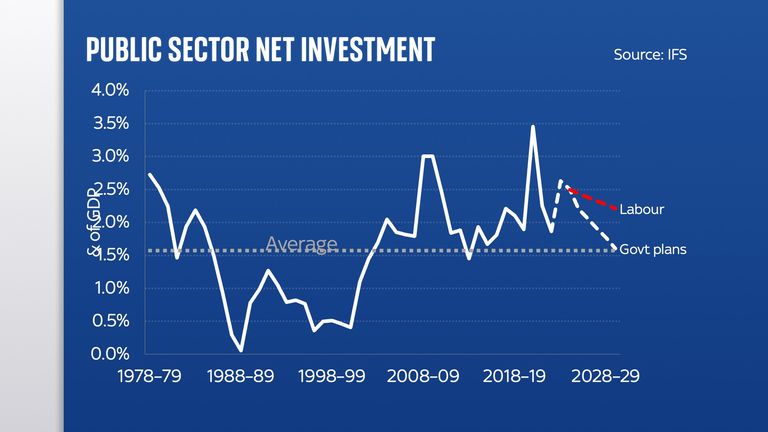

Today the Labour Party says the ambition is not to raise green investment by that amount but to lift it to that amount – and since the government is already budgeting about £8bn to be spent on green investment in the coming years, the potential increase is actually closer to £20bn.

And while this sounds significant, actually it wouldn’t be enough to prevent overall public investment spending from falling in the coming years – albeit less quickly than under the existing government plans.

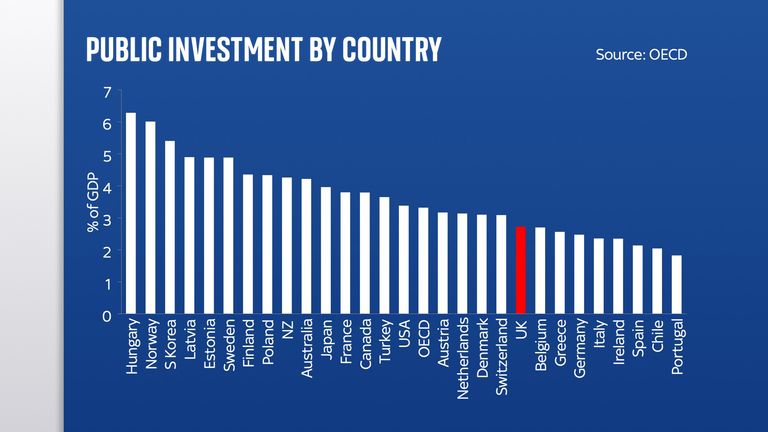

In other words, it’s not as if this extra money will turn Britain into an investment powerhouse. On the contrary, the UK currently has some of the lowest levels of public investment of any leading developed economy.

Labour’s plans will more or less keep Britain where it is in the international rankings; the current Conservative plans will mean the UK becomes, in public spending terms, one of the lowest-investment countries in the developed world.